Brightening Outlook Buoys U.S. Chemical Industry

A year ago, at the end of 2019, our outlook for the U.S. chemical industry was for modest but positive growth. Amid the backdrop of a maturing economic expansion, challenges from protectionist trade policies, a global manufacturing slowdown, and uncertainty about the upcoming U.S. presidential election, the industry faced multiple headwinds. As news of a novel coronavirus in China captured the world’s attention during the first month of the year, companies prepared for a significant supply disruption as it became clear that quarantine directives to contain the outbreak would substantially impact manufacturing in China, the world’s largest chemicals producer. Just two months later, by the end of March, as much as half the world’s population was under some kind of lockdown order and demand for goods and services collapsed with unprecedented speed and severity.

COVID-19 has been a classic “black swan” event. Nobody at this time last year anticipated a global pandemic that would close borders and shutter businesses, plunging the world into the fastest and deepest downturn since the 1930s. Between February and April 2020, more than 22 million Americans lost their jobs as large swaths of the U.S. economy were closed for business and a majority of office workers were forced to work remotely from home.

The global pandemic hit the pause button on the $84-trillion global economy. Spending fell throughout the world and across all economic sectors in a matter of weeks. With more than 85% of basic and specialty chemicals sold to industrial consumers, all but a handful of products suffered substantial negative impacts. However, several chemicals — those tied to personal protective equipment (PPE), disinfection and sanitation products, medical supplies and equipment, and protective barriers — saw soaring demand that partially offset devastating declines in demand for other products. Plastic packaging also got a positive bump through food distributors redirecting bulk foods intended for institutional markets into smaller household-sized packages, alleviating shortages at the retail level.

Despite the increased demand for several COVID-19-critical materials, overall U.S. chemical production fell in 2020 but not as much as that in just about every other manufacturing sector. Motor vehicle production dropped sharply, as did output in its lengthy supply chain. However, housing made strong gains in 2020 due to shifting patterns of remote work and record-low interest rates. Most other end-use segments declined, though.

A Turnaround

While the downturn was rapid and deep, with second quarter gross domestic product off by nearly a third (on an annualized basis), the recovery that likely began at the end of that quarter has been swift and demonstrates the resiliency of the U.S. economy, supported by unprecedented Federal stimulus and a broad expansion of unemployment benefits. However, moving into the end of 2020, the strong rebound during third quarter tapered off and the U.S., like most of the rest of world, experienced a troubling surge in the number of new cases, hospitalizations and deaths from COVID-19. With renewed restrictions across much of the country, the outlook remains uncertain as the worsening health situation casts clouds on confidence, mobility and spending. Fortunately, a number of vaccines seem poised for widescale use while the medical community has made significant gains in treatment for patients, improving outcomes for millions of infected people.

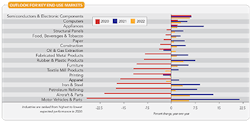

Figure 1. Most sectors should achieve good growth through 2022.

As the world emerges from this health crisis in 2021, the American economy continues to boast fundamental advantages. The U.S. has undergone significant tax and regulatory reform in recent years and American workers are among the most productive in the world. In addition, the U.S. enjoys an energy advantage that is the envy of many nations. Protectionist policies enacted during the Trump administration harmed many U.S. manufacturers and consumers but the incoming administration likely will take a more-measured approach to trade that will stimulate U.S. economic growth. The American Chemistry Council (ACC) looks forward to working with the Biden/Harris administration and members of Congress to ensure the right policies are in place to support sensible, science-based regulations and robust and responsible energy and infrastructure development that will keep our industry and economy on a path to strong growth.

As factories reopened toward the end of the second quarter and inventories were drawn down, demand has firmed across many economic segments. However, restrictions on trade movements during the lockdowns and weakness in many trading partner economies caused a significant drop in U.S. exports of goods in 2020. As a result, industrial production fell by 6.9% in 2020, with declines in nearly every industry sector. With the recovery in place, however, industrial production will continue to strengthen and should increase by 3.7% in both 2021 and 2022. Growth expectations are positive for all industries in 2021 except oil and gas; motor vehicles, aerospace, appliances, iron and steel, petroleum refining, and plastic and rubber products should show the largest gains (Figure 1).

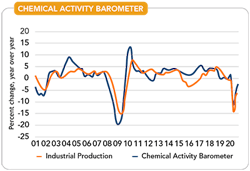

Figure 2. This leading indicator points to continued recovery this year.

The Chemical Activity Barometer — an ACC-developed composite leading index of broader industrial activity — rose for the seventh straight month in November. While key indicators are mixed, they remain largely positive and point to continued recovery in the U.S. economy in 2021(Figure 2).

Light vehicles are an important market for chemicals, representing over $3,170 in chemicals per vehicle. Sales were very strong during 2015–2019, averaging almost 17 million units each year. However, the U.S. light vehicle industry experienced sizeable lockdowns and, as a result, sales should total only 14.4 million in 2020. A V-shaped recovery in this industry is occurring and sales should rise to 16.4 million in 2021. An eventual return to normal job and income levels as well as some continuing pent-up demand will support this rebound. The outlook is for sales to improve and remain at elevated levels over the next several years. (Editor’s note: In addition, the automotive market likely will play an important role in the advance of circular chemistry, i.e., use of renewable and end-of-life materials. See: “Cars Can Drive Circular Chemistry Ahead.”)

Housing also consumes a lot of chemicals; the outlook is for a gain this year (despite COVID-19) to 1.34 million units as many households move from urban areas to suburban, ex-urban and rural areas. Low mortgage rates also provided some much-needed stimulus. Expected growth in household formation — the leading determinant of housing demand — coupled with job and income gains in the long-term will support continuing, albeit more modest progress through 2025. However, shortages of labor and available lots will constrain the pace of growth. Housing starts are set to edge higher to 1.38 million in 2021 and 1.36 million in 2022. This is a market that could surprise to the upside.

Going into 2020, the American chemical industry was poised for positive (but weak) growth. Following a challenging 2019 that reflected ongoing trade tensions and slower growth abroad, the industry faced further headwinds as the global economy struggled to maintain growth. As it unfolded, the pandemic initially disrupted chemical supply chains that ran through China. Then, broad lockdowns sent economies around the world off the rails and demand for chemicals in many important end-use markets declined sharply.

Policymakers quickly recognized the important role of the chemical industry in producing the materials to combat COVID-19 (fibers and resins for PPE, hand sanitizer and disinfectant ingredients, packaging materials for retail food distribution, medical plastics for test kits and ventilators, safety barriers, etc.). The U.S. Department of Homeland Security designated chemical manufacturing an essential industry because of its critical role in providing these materials.

Despite increased demand for materials related to the pandemic response, chemicals that support other end-use markets, e.g., durable goods, oil and gas extraction, refining, etc., saw a sharp fall in demand during the lockdowns. As the recovery emerged in the third quarter, demand for chemicals firmed. In 2020, chemical production (excluding pharmaceuticals) likely fell by 3.6%, the largest decline since the Great Financial Recession, but one of the better performances within the manufacturing sector.

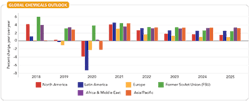

Chemical production also declined in most worldwide regions in 2020 but should rebound, in some cases even more strongly than in the U.S. (Figure 3).

Figure 3. Worldwide growth in chemicals output should occur.

Prospects By Segment

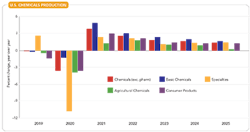

As the recovery continues to build and end-use and export markets strengthen, chemical output should rebound by 3.9% in 2021 and 2.7% in 2022 (Figure 4). The competitive advantage that U.S. chemical production enjoys due to investment in unconventional oil and gas resources will foster this growth. Looking ahead, as the world economy climbs out of the deepest recession since the 1930s, growth rates through 2025 likely will lag those of the previous five years. Capacity utilization dropped to 78.4% in 2020 as demand fell at the same time new capacity came on line. A slower pace of capacity growth and stronger demand will push operating rates up through 2025.

U.S. basic chemicals (inorganic chemicals, petrochemicals, plastic resins, synthetic rubber, and manufactured fibers) continue to enjoy a competitive advantage. Going into 2020, higher tariffs were only the first hurdle to a difficult year. During the lockdowns, demand from many end-use customers, both domestic and abroad, collapsed. Basic chemical production declined 1.3% in 2020, as strong demand for plastic resins partially offset weaker growth in other segments. In fact, plastic resins were the only major chemical segment to post growth in 2020, up by 0.9%. Production of petrochemicals and organic intermediates that supply the resin segment among others fared relatively well, declining by only 0.9%. Inorganic chemicals fell by 1.9%. However, with tire production at a small fraction of its usual levels during the second quarter, synthetic rubber fell by 18.9%. Manufactured fibers, a segment under long-term structural pressures, fell by 11.7%. All basic chemical segments should rebound strongly in 2021 as customer markets and the trade environment improve, and shale-advantaged feedstock production expands.

Figure 4. Output of basic chemicals should pace the ongoing rebound.

While the year was challenging for basic chemicals, it was especially difficult for specialty chemicals. Even before the pandemic, specialty chemicals had started the year on a soft note with weakening customer markets. As end-use market demand fell through the second quarter and energy investment collapsed, specialty chemicals declined by 10.8%. However, as the industrial sector recovers in 2022 and beyond, specialty chemicals’ growth will resume.

Within the U.S., all regions saw declining chemical production in 2020 — with the largest drops in the specialties-heavy Northeast, Mid-Atlantic and West Coast regions. During 2021, the recovery that began in the second half of 2021 will evolve and all regions will see growth. The Gulf Coast region should experience the largest gains.

The chemical industry, which is the largest energy-consuming sector in America’s manufacturing base, continues to benefit from investments to take advantage of the U.S. energy abundance. While gains in U.S. energy production stumbled in 2020 due to the unprecedented collapse in transportation demand brought on by social distancing measures, the U.S. remains the world’s largest energy producer.

As the COVID-19 recession accelerated, many companies delayed or extended projects. In addition, heightened uncertainty led to cancellation of some projects. As a result, chemical industry capital spending likely fell by 14% in 2020 and will experience only a modest 4.8% gain in 2021. Growth will remain moderate in subsequent years but could pick up afterward if the business environment proves supportive. By 2025, U.S. capital spending by the chemical industry should approach $37.3 billion, nearly three times the level of spending at the start of the last cycle in 2010 (Figure 5). Investment for bulk petrochemical and organic intermediates, along with that for plastic resins, will dominate. Spending for instrumentation, process equipment, and structures presents strong opportunities during this period.

Figure 5. Investment in U.S. production plants will continue to increase.

Following seven years of solid job growth, chemical industry employment fell during the pandemic because of demand declines in other segments. Overall, the industry lost 14,900 jobs (2.7% of its workforce) in 2020. Looking ahead, employment should recover and stay relatively steady through 2025 as increased productivity offsets output gains. Chemical workers are among the highest paid in the manufacturing sector (averaging $87,500 in 2019) and those earnings support local communities. (Editor’s note: Salaries of engineers in the industry range even higher, see: “Salary and Satisfaction Survive the Pandemic.”)

U.S. exporters in 2019 faced headwinds coming from escalation of trade tensions and uneven growth abroad. With retaliatory tariffs in place and continued trade tensions, chemical exports declined 2.5% in 2019. Imports also fell by 3.9% with the imposition of U.S. tariffs and a weakening manufacturing sector. In 2020, of course, the pandemic negatively affected port access and aggregate demand for goods dramatically. Globally, trade volumes declined 12.4% in 2020, only slightly less than during 2009. Chemical exports also fell sharply, down by 9.0% to $124.0 billion. Imports also dropped for a second year, by 4.9% to $96.8 billion.

Upbeat Outlook

At the end of 2020, the U.S. chemical industry was well into its recovery from the pandemic-induced recession. Because of its significant contributions to the response to COVID-19, the industry’s losses in 2020 were comparatively less severe than those in other manufacturing sectors. Moving forward into 2021, the industry will continue its recovery and, spurred by the ongoing advantage from abundant U.S. energy resources (in particular, natural gas liquids), production and exports are poised for growth.

The new capacity started up recently and slated to come online in the years ahead puts the U.S. in a top competitive position for the foreseeable future. More than half of the investments announced since 2010 have been completed or currently are under construction. As the global economy expands and key-end use markets strengthen, we expect growth in basic chemicals as well most other chemical segments through 2025. As new production expands to meet growing global demand, the U.S. chemical industry will remain a key employer, providing high-paying jobs and supporting local communities. Provided that access to export markets remains open to American producers and U.S. energy development continues, shale-advantaged chemicals sourced from the U.S. will meet much of this growing global demand.

Significant risks to this outlook include, most prominently, the containment of COVID-19. As of presstime, infection rates in the U.S. and Europe are climbing once again, leading to new restrictions on mobility. While several vaccines are progressing quickly, meaningful vaccine distribution may not occur until well into 2021. Despite the recovery currently underway, the momentum of the world economy can’t gain traction until the health crisis abates.

KEVIN SWIFT is chief economist and managing director of the American Chemistry Council, Washington, D.C. MARTHA GILCHRIST MOORE is senior director, policy analysis and economics, for the American Chemistry Council, Washington, D.C. Email them at [email protected] and

[email protected].