For many, 2012 and 2013 may be two years to forget as austerity in developed nations, recession in Europe, slowdown in China, and uncertainty all combined to hinder growth. The European economies seem to be emerging from a secondary recession but recovery is tentative at best. The BRIC [Brazil, Russia, India and China] economies have been weighed down (much like a brick) but it does appear that China now is improving. Inflationary pressures have eased and monetary policy around the world is striving to foster growth.

The manufacturing sector represents the primary customer base for chemicals. Global manufacturing entered a soft period in 2012, with particular weakness in Europe and East Asia. However, manufacturing is beginning to turn upward, led by the United States, the United Kingdom and other nations.

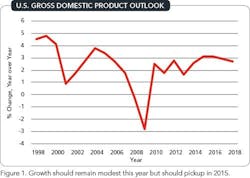

Figure 1. Growth should remain modest this year but should pickup in 2015.

Table 1. Each of the indicators should improve during 2014 and 2015.

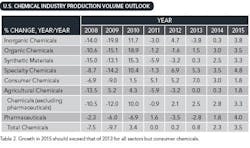

Table 2. Growth in 2015 should exceed that of 2013 for all sectors but consumer chemicals.

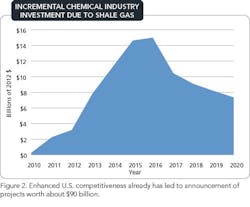

Figure 2. Enhanced U.S. competitiveness already has led to announcement of projects worth about $90 billion.

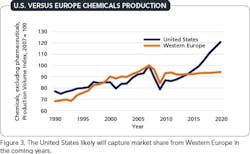

Figure 3. The United States likely will capture market share from Western Europe in the coming years.

THOMAS KEVIN SWIFT is chief economist and managing director of the American Chemistry Council, Washington, D.C. E-mail him at [email protected].