Still working off the cushion of excess savings accumulated during the pandemic and benefiting from higher wage growth, consumers remained resilient through much of 2023. Interest rate hikes in the past year and a half are putting the brakes on an overheated economy, causing a slowdown in price growth and employment gains. As the year winds down, consumers are starting to feel the pinch of over two years of inflation, higher borrowing costs, resuming student loan repayments and the depletion of pandemic-induced savings. These factors are expected to contribute to a slowdown in consumer spending, with a drop from a 2.2% gain in 2023 to a projected 1.0% growth in 2024.

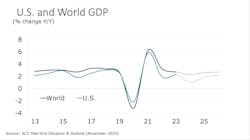

Business investment, boosted by recent legislation like the Inflation Reduction Act and CHIPS Act, showed solid growth in 2023. However, the outlook for 2024 is less optimistic, with higher borrowing costs, stricter lending standards and a slowdown in consumer spending expected to impact business investment. U.S. GDP is expected to slow to 1.1% in 2024, down from a 2.3% gain in 2023.

Unemployment, an important indicator of the U.S. economy, has risen slightly as the historically tight labor market starts to ease. While inflation has moderated, it remains above the Federal Reserve's preferred target. A steady deceleration in price growth is expected to continue, but the Fed has not ruled out the possibility of future rate increases.

Globally, higher interest rates are contributing to a slowdown in economic growth across various regions. Despite global GDP growth of 2.7% in 2023, growth is expected to slow to a 2.3% pace in 2024. Global trade, nearly stalling with a meager 0.3% increase in 2023, is anticipated to recover modestly in 2024, with trade volumes projected to grow by 2.9%.

Amid these broader economic dynamics, the chemical industry is deeply embedded in the U.S. economy. With over 85% of basic and specialty chemicals consumed by the industrial sector, the outlook for industrial production remains weak. The manufacturing sector, a major consumer of chemistry products, struggled throughout the year. Despite a modest 0.3% rise in U.S. industrial production in 2023, expectations for 2024 indicate flat growth. However, industrial recovery is anticipated by mid-2024, gaining momentum into 2025.

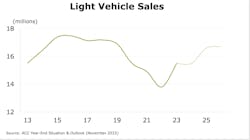

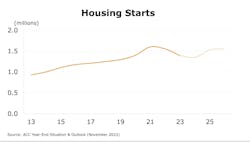

Demand for chemistry from the auto sector, a standout in a challenging year, witnessed sales rising to 15.5 million in 2023. Nevertheless, growth in vehicle sales is expected to remain flat in 2024 due to higher borrowing costs and economic uncertainties. Housing, another significant end-use market for chemicals, is expected to see a further decline in starts to 1.35 million in 2024 before a recovery emerges in 2025 as interest rates decrease.

Turning to the chemical industry, the unprecedented destocking cycle that began in mid-2022 affected production volumes throughout 2023. A rotation from consumer spending on goods to services led to one of the longest inventory cycles in recent memory. While inventory destocking has largely been resolved, signs of significant customer inventory rebuilding have not yet materialized. Chemical output volumes fell by 1.0% in 2023 compared to 2022, with a modest 1.5% gain projected for 2024. Because of the chemical industry's early position in the supply chain, a recovery in chemicals should precede a broader industrial recovery.

All segments of the industry declined in 2023, with the exception of consumer products which benefited resilient consumer spending. Basic chemicals declined by 2.5%, specialty chemical output was down 1.4%, and agricultural chemicals output was also lower. In 2024, a modest recovery is expected across all segments, with stronger growth prospects into 2025. Despite near-term challenges, the long-term outlook remains positive, driven by the U.S.’s competitive advantage in natural gas liquids feedstock and manufacturing capacity expansions spurred by legislative initiatives, including the Inflation Reduction Act, the Bipartisan Infrastructure Law, and the CHIPS Act. The pandemic and subsequent supply chain disruptions underscored the need for companies to be closer to their North American customer base, encouraging re-shoring and near-shoring of some manufacturing capacity.

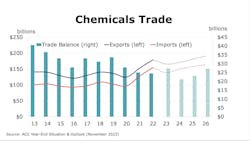

The U.S. chemical industry exports nearly 30% of its production. Weak global manufacturing led to a softening of export demand for chemical products. Following two years of double-digit increases, U.S. chemical exports fell 7.5% in 2023. Imports fell 10.0%, resulting in an increase in the U.S. trade surplus in chemicals. Exports are expected to recover by 3.1%, while imports are expected to increase by 8.2%. However, the U.S. maintains a trade surplus in chemicals throughout the forecast horizon.

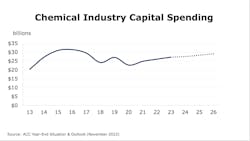

Chemical industry capital spending slowed to a 4.3% gain in 2023 and is expected to decelerate to a 1.1% gain in 2024 before picking up in 2024 and 2025. A recent survey of ACC members indicated that companies allocated 25% of their capital budgets toward sustainable manufacturing, including investments in lower emissions technologies.

Despite lower chemical production in 2023, employment levels were higher compared to 2022. As with the rest of the economy, finding workers has been challenging, and firms have held onto workers. Chemical industry employment is expected to remain flat in 2024 before expanding in 2025 and beyond. With average annual pay of more than $97,000, chemical industry jobs support local communities.

Globally, chemical production expanded by 0.3% in 2023, with gains in the Asia/Pacific, Middle East & Africa, and former Soviet Union countries offsetting sharply lower output in Europe and smaller declines in North America and Latin America. The outlook for 2024 is brighter, with expectations of 2.9% growth as global industrial production picks up.

Looking beyond the short-term challenges, the long-term prospects for U.S. chemistry remain positive, driven by competitive energy fundamentals and the resurgence of U.S. manufacturing. However, the threat of rising regulatory impact on the chemical industry in the U.S. looms large and could potentially undermine these advantages and opportunities. Additional risks include policy mistakes from the Fed and geopolitical uncertainties that could impact the chemical industry's trajectory.

About the Author

Martha Gilchrist Moore

Chief Economist, American Chemistry Council

Martha Gilchrist Moore is chief economist and managing director of the American Chemistry Council, Washington, D.C.